Amex Rewards Program Powered By Blockchain Is A Gold Mine For Data In Many Ways

American Express’ new blockchain technology could give the card issuer a massive load of data on product purchases. Amex has built a distributed ledger that merchants can use to tie card rewards to products they want to move off the shelf. For instance, if an auto insurance company wants to sell more policies or a coffee shop wants to serve more large coffees, it could offer American Express reward points for the featured items to make them more appealing. A merchant that wants to get people to download its app or join a program could offer the same enticement.

The blockchain lets merchants for the first time offer Amex rewards on their own channels, such as websites and apps, rather than through the card company’s channels. But the real value of the company’s blockchain may be the purchase data it will record. Product manufacturers want proof and an audit trail that show a promotion led to the purchase of a product, said consultant Richard Crone. Such product-specific information, referred to as “SKU-level data” because it includes the stock-keeping unit number on each product, is coveted.

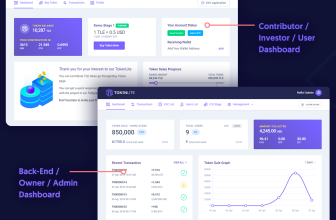

Leveraging blockchain gives us a level of detail that’s a bit unique, so we can track down to the point how and where points were awarded, the promotion they were awarded for, and that provides us with a lot of great insight. It also gives the merchant insight into how customers are behaving that we can share back with them in reporting and a dashboard. Over time, they will have real-time access to the performance of these campaigns to be able to tweak things in real time

Using its new blockchain, American Express and its partners will be able to see and analyze such data. Users of the blockchain would be able to see what, when, where and how people bought things, and that could feed artificial intelligence programs that could present relevant offers.