Your guide to ICO and STO

Initial Coin Offering (ICO) is an unregulated way in which funds are raised for a novel cryptocurrency venture. Security Token Offering (STO) is also a fundraising process but has legal compliance and are generally financial instruments like equity or income shares.

The background behind these offerings can be explained as follows. A company typically grows as its revenues expand and this is generally an organic process. In order to accelerate this process, companies can look forward to outside investors. This is a give-and-take system where the investors are given a chunk of ownership stake.

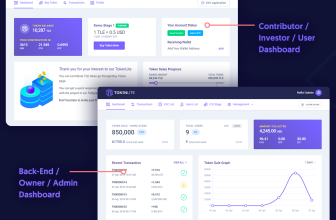

ICO functions by offering early merchants a new coin in exchange for their beneficial investment. The investors can look forward to the coin to perform well in the market and make a tidy profit. STO works on the similar model but adapts to provide a digital representation of an actual asset.

An appreciation through numbers

The year 2017 was the time which witnessed ICOs getting immense attention. Almost 435 ICO projects were successful, with each raising an average of 12.7 million U.S. dollars summing up to a whopping 5.6 billion U.S. dollars.

The ICO mode of crowdfunding hit the bullseye in 2018 surpassing the funds collected in 2017 by a large margin. In a matter of just 5 months, an estimated 13.7 billion U.S. dollars was reached.

However, the journey is not always smooth. With the tenacious competition, there has been a sizeable percentage of ICO projects which have not been successful. This has been further fueled by the fact that an almost multitude of cryptocurrencies are in circulation.

ICO – A study

When a cryptocurrency firm intends to raise money through ICO, the process starts by building awareness. A detailed white paper needs to be drafted which conveys the various ideologies of the project.

The white paper generally starts by answering what the project is all about and the key solutions upon completion. It gives a broad picture of how much money is needed for the venture and what percentage of the stake the owners plan to keep for themselves. Other salient elements are types of payment accepted and the duration of the campaign.

As the campaign sets in, customers can purchase the virtual coins either through native currency or other cryptocurrencies. The new coin is technically called as a token. The fallback in place is that if the required amount of money is not collected by the company, customers are refunded and the ICO is branded unsuccessful.

ICOs are often compared to Initial Public Offering (IPO). While both of them work on the basics to offer something in exchange for funds, ICO is more of a donation and IPO motivates a prospective return for the investments.

ICO also differs from IPO by being largely decentralized. There is no governing body overlooking the proceedings. ICO also stands out as being unregulated and many regulatory giants have no influence on them.

The structure of an ICO can be primarily dual. There can either be a static or a dynamic supply of the number of tokens. In the static model, the more funds that are received, higher would be the token price. In the dynamic approach, there is no upper cap on the number of tokens issued.

STO – A study

STOs were meant to supersede ICO. STO promises greater security in the blockchain ecosystem. STO builds credibility to token offering especially with reference to regulatory bodies and high volume investors.

STOs bluntly differ from ICO by not being traditional tokens or cryptocurrencies. STO can be plainly expressed as being digitized securities. An analogy can be made with respect to securities like stocks and bonds. A security token would fit in as a digitized version of a bond certificate.

Smart contracts form the backbone to materialize STO. Smart contracts are programmable pieces of intelligence that reside on the blockchain and control the use cases or the flow of clauses. Smart contracts also regulate the process to purchase tokens, their trade and fully compliant way of selling them.

STOs sail over ICO in their ability to enact fractional ownership of an asset and its trade on global security token exchanges. This is a feature impossible with ICO based crowd sales.

Traditional paper-based securities suffer from drawbacks like lawyers, custodians or other intermediaries involved. There is a large scope for human error. Since security tokens exist as soft copies and are fully transparent, they are more precise.

STOs are adjudged as being trustless. With the blockchain cited as immutable and public, no trust is required between parties transacting with security tokens. Aspects of security token like issuance and trading are well recorded on the blockchain.

ICO vs STO and the future

ICO and STO both have their own great features and set of problems. ICO clearly fares above STO for its simplicity. ICO generally has no entry barrier and is a clear winner to raise funds quickly.

The marketing strategy involved for ICO also enjoys the fact that it is mostly digital. Company websites, social media, and other online forums would mostly suffice. STOs slightly lag in this endeavor for being more tedious to market.

However, ICOs are largely put down by sometimes being fraudulent and is proportional to the volatility of the crypto market. STO is way ahead in this aspect by being registered with Securities and Exchange Commission (SEC). The SEC only allows projects that are serious and adds value to the community.

It should be clear that STOs are the future. There is a small community that resorts to ICO in a hope to keep their coin active. Although STO appears more bureaucratic, people are becoming smarter to invest their money wisely and not land in dangerous pitfalls.

Conclusion

We have endeavored to educate you on the handouts of ICO and STO which have virtually mesmerized the masses. The general advice and a word of caution are that do not get easily trapped into deals which may seem visibly appealing.

You must have clear goals to make through your investments an excellent gain. ICOs are phasing out and your footprint in STO will definitely be worthy if you make an effort to study the clauses while being a beacon of awareness.